How Taiwan's Chipmaking Mastery Shapes Global Tech Politics

Insights | 17-10-2023 | By Paul Whytock

Over the past forty years, Taiwan has created an omnipotent technology position for itself that not only makes it one of the most important manufacturers of advanced semiconductor technology but also a potential influencer of certain global affairs.

How so? Despite the aggressive conflicts occurring in our supposedly advanced world, the one thing major manufacturing countries cannot do without is a stable supply of microchips, and this includes China, Europe, the USA, and any other country that relies on chips to produce the technology it needs for domestic consumption or to maintain the export trade critical to its economy.

Taking just one of Taiwan’s major chip makers, TSMC, we know that it produces 62% of the semiconductor chips used globally, and of those, close to 85% are very advanced devices essential for anything from modern smartphones to intelligent military systems. And it produces these with great speed.

![]()

The Technical Marvel of Semiconductors

Semiconductor manufacturing is a marvel of modern engineering. The intricate processes, from doping to etching, require not only advanced machinery but also a deep understanding of materials science and quantum mechanics. TSMC's dominance isn't just about quantity but also the quality and advanced nature of their chips. Their ability to produce at the 2nm scale, as mentioned later in the article, is a testament to their technical prowess.

Not surprisingly, it has a market capitalisation approaching 13.56 trillion NTD (New Taiwanese Dollars), which equates to around 450 billion Euros.

World Influence

Just those last facts alone would have many industry observers suggesting it would make Taiwan vulnerable to military invasion in a bid to grab its chipmaking technology and the world influence their possession would bring. And many observers feel that fact alone could tempt China to invade Taiwan.

But they would be wrong, and here are some crucial reasons why.

According to an analysis by GlobalData, "China consumes around 40% of all the microchips made globally and spent over $400 billion last year on semiconductor devices". However, as a manufacturer, it is only in the region of 10% self-sufficient.

This means any significant shortfall in its supply of the imported chips it depends on would severely reduce its production of millions of electronically-based products. This, in turn, would decimate its export trade with catastrophic effects on its national wallet.

Would China Invade Taiwan?

But some may say, isn’t this even more reason why China would like to have control of Taiwan’s chip manufacturers? Not necessarily. Semiconductor fabrication manufacturing is a delicate process and must have constant and absolutely stable power and water supply, and the plant must be well insulated against vibrations.

The journey from raw material to finished chip takes around 80 days and involves process operations using ion implanters, photolithographic steppers, deposition systems, oxidation furnaces and etchers. Any disruptive break during that period can mean writing off vast amounts of a very costly, unfinished product.

So, wafer fabrication plants would not tolerate the damage and disruption that military conflict could impose. There is also the possible threat that Taiwan’s wafer fabs are already geared for destruction should any invasion force try to take them.

This could leave China in the difficult position of trying to source microchips from other countries, and some of those may be sympathetic towards Taiwan, just as the US is.

It's worth noting that the semiconductor industry isn't just about manufacturing capacity but also about innovation. The constant push for miniaturisation, better power efficiency, and increased performance requires significant R&D investments. TSMC's leadership in this space is a testament to their commitment to innovation.

Increased Foundry Capacity

Because of the current global shortage of semiconductor devices, Taiwan plans to build six new chip plants and, in three years, is expected to have 45% of global foundry capacity, which is predicted to rise to 55%. And this production capacity includes a high proportion of advanced devices.

China is a big customer of Taiwan, as is the United States. Neither of them would want to see any supply line interruptions caused by conflict. America’s position on this is different from China’s in that it has a greater production capacity; an important part of that is it is way ahead of China in terms of leading-edge developments. It also has a greater diversity of semiconductor companies operating in its territory.

Advanced Technology

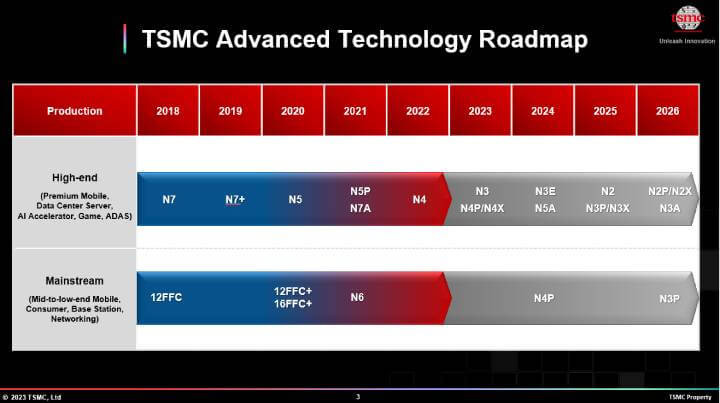

Returning to the point about Taiwan’s advanced position in semiconductor manufacturing, TSMC recently disclosed information about its N2 2nm-class production plans.

The company’s N2 technologies will be increased with the addition of N2P with backside power delivery and N2X for high-performance computing.

The N2 manufacturing process employs GAAFET transistors, which offer the advantage of reduced leakage current and the facility to adjust channel width performance and power consumption. The company believes it can achieve power consumption reductions of up to 25%

Such advancements are pivotal in the era of the Internet of Things (IoT) and Artificial Intelligence (AI). As devices become smarter and more interconnected, the demand for efficient and powerful chips rises. TSMC's innovations not only cater to this demand but also set the industry standard.

Backside Power Delivery

TSMC also plans to add backside power rails to N2’s Nanosheet GAA transistors. Backside power delivery decouples I/O and power wiring by moving power rails to the back, which helps resolve problems such as raised via resistances.

This is a significant breakthrough because chip companies are consistently looking at ways they can reduce resistance when it comes to power semiconductor circuitry.

International Collaborations

When it comes to future plans, Taiwan’s chip makers are also mindful that international collaborations further increase the security of their production of advanced devices.

Initiatives like the recent signing of a European deal by TSMC are evidence of this. It has teamed up with three major European players in the global electronics arena, Infineon Technologies, Robert Bosch GmBH and NXP Semiconductors. TSMC will own 70% of the venture.

The keystone to this initiative is the formation of the European Semiconductor Manufacturing Company (ESMC) in Dresden, Germany. It will be a 300mm fab designed to provide chips for the automotive and industrial sectors, something the car makers will no doubt be very happy about, given the world shortage of suitable semiconductor devices that has severely hindered their production rates over the past few years.

The planned fab is expected to have a monthly production capacity of 40,000 300mm (12-inch) wafers on TSMC’s 28/22 nanometre planar CMOS and 16/12 nanometre FinFET process technology, further strengthening Europe’s semiconductor manufacturing ecosystem with advanced FinFET transistor technology and creating about 2,000 direct high-tech professional jobs. ESMC aims to begin construction of the fab in the second half of 2024, with production targeted to begin by the end of 2027.

Looking Ahead

In the ever-evolving landscape of semiconductor manufacturing, Taiwan, led by giants like TSMC, continues to solidify its pivotal role. As the world becomes increasingly dependent on advanced technology, the importance of a stable and innovative semiconductor supply chain cannot be overstated. International collaborations, cutting-edge advancements, and geopolitical considerations all intertwine in this intricate dance of silicon and circuits. As we look to the future, it's evident that Taiwan's semiconductor prowess will not only shape the trajectory of global tech industries but also influence the delicate balance of world power dynamics.