What’s the One Big Reason Why China Will Not Invade Taiwan?

Insights | 08-12-2022 | By Paul Whytock

The answer is microchips. And before you react by thinking that’s precisely why China would invade Taiwan to get hold of that country’s highly successful chip fabrication sites, think again.

The enormous global demand for semiconductor products and the influence they have on the lives of billions of humans, coupled with their significant effect on international trade and productivity, mean disruption of supply and development of microchips because of war would have a substantial adverse effect globally that would impact equally as much on the aggressor.

Significant Supply Chain Chip Shortages

Here are some crucial reasons that may deter China from invading Taiwan.

According to a recent analysis by GlobalData, China consumes around 40% of all the microchips made around the world and spent over $400 billion last year on semiconductor devices. However, as a manufacturer, it is considered to be only in the region of 10% self-sufficient.

This means any significant shortfall in its supply of the imported chips it depends on would severely reduce its production of thousands of electronically-based products. This, in turn, would decimate its export trade, hitting its national wallet hard.

So what, you may think! China would have control of Taiwan’s chip manufacturers. Not necessarily. Semiconductor fabrication plants are delicate in so much they need constant and absolutely stable power and water supply and have to be well insulated against vibrations.

The journey from raw material to finished chip takes around 80 days and involves process operations using ion implanters, photolithographic steppers, deposition systems, oxidation furnaces and etchers. Any break of supplies during that period can mean writing off vast amounts of a very costly unfinished product.

Inoperative Fabrication Plants

Consequently, such facilities could quickly become inoperative in a serious conflict, either deliberately or by accident.

This could leave China in the difficult position of trying to source microchips from other countries, and some of those may be sympathetic towards Taiwan, just as the US is.

Because of the current global shortage of semiconductor devices, Taiwan plans to build six new chip plants and, in three years, is expected to have 45% of global foundry capacity, which is predicted to rise to 55%. And this production capacity includes a high proportion of advanced devices.

China is a big customer of Taiwan, as is the United States. Neither of them would want to see any supply line interruptions caused by conflict. America’s position on this is different from China’s in that it has a greater production capacity; an important part of that is that it is way ahead of China in terms of leading-edge developments. It also has a greater diversity of semiconductor companies operating in its territory.

Only recently, Taiwan’s biggest chipmaker, the Taiwan Semiconductor Manufacturing Company (TSMC), decided to create new factories in the United States and Japan.

Chinese firms don’t feature in the top list of electronics companies, whereas the likes of Intel, Qualcomm TSMC, ASML, Samsung and NVIDIA do. Along with these, Japan has a leading position when it comes to providing most of the speciality chemicals used in semiconductor manufacture.

However, regarding the supply of crucial electronically-related materials, China has an important card to play; it has the world’s largest lithium reserves.

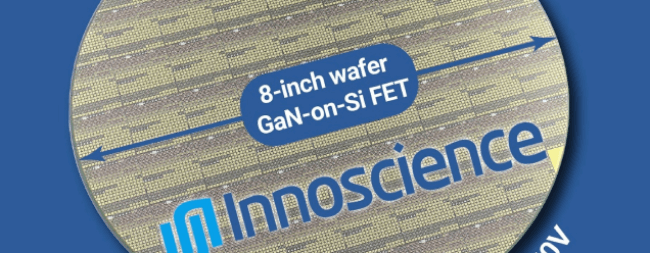

In addition to that, there is also Innoscience, the Chinese low-cost GaN-on-Si power solutions manufacturer. The company has established a mass production 8-inch wafer fabrication plant for GaN-on-Si devices in Zhuhai and also has a facility in Suzhou.

There is also China’s top chipmaker, the Semiconductor Manufacturing International Corp (SMIC), which has made a key technological breakthrough to achieve 7nm chip manufacture. Some industry analysts believe the company will be able to produce devices at this level without advanced production equipment.

Stringent Export Controls

This could be a crucial factor given America’s recent decision to implement stringent export controls regarding the electronics technology that can be supplied to China.

It means that special export licenses must be obtained by American companies in order to supply US electronics technology to China.

It will, in effect, stifle the sale of artificial intelligence, high-performance computing and supercomputers to China, and it doesn’t end there.

Washington is also barring US citizens or companies from working with Chinese chip producers except with specific approval. The controls also inhibit leading-edge chip manufacturing tools and technology exports to China.

The White House has framed the measures as an attempt to curb Chinese military use of high-end chips. Understandably, the US wants to blunt the military ambitions of an increasingly assertive rival.

What happens if China invades Taiwan?

A Chinese invasion of Taiwan would trigger an even bigger wave of sanctions against it, severely hindering its current and future semiconductor technology plans.

The problem is that it would hit so many national economies and have a far higher global impact than that caused by Russia’s invasion of Ukraine, where the world has seen how quickly food supplies can be disrupted.

It’s all a technology-balancing act when it comes to keeping the peace over Taiwan. Seen one way, this web of dependencies helps avoid war, and China’s reliance on TSMC and other Taiwanese chip companies deter the Communist Party from invading the island.

Alternatively, the United States’ dependence on the extensive chip fabrication capabilities provided by Taiwan means it will continue to support the island from political, financial and military perspectives.

Financially, TSMC may receive US subsidies linked to assurances that the company will not further expand in China. These subsidies will be provided under America’s recently passed CHIPS and Science Act of 2022.

In addition, Taiwanese officials are considering a new US-proposed Chip 4 alliance which aims to unite the American chip supply chains with those of Taiwan, South Korea and Japan - but not China.

Taiwan provides both East and West with the high-performance semiconductors needed in many military systems and also a mass of consumer products. Whereas Intel may be a familiar name to consumers worldwide, TSMC is not, but aggressive conflict could soon see its name hitting the headlines.

Some top semiconductor executives have made their views crystal clear following China’s recent sabre-rattling military drills following America’s House of Representatives Speaker Nancy Pelosi’s visit to Taiwan.

Robert Tsao, the founder of Taiwan’s United Microelectronics, said he would provide a $100 million donation to support Taiwan’s military forces, and there is no doubt many Taiwanese companies have substantial financial reserves that could bolster Taiwan’s defences.

Finely-Tuned Balancing Act

Another example of the finely-tuned balanced act of keeping the peace in Taiwan is the fact that Taiwan’s biggest electronics manufacturer TSMC is building production centres in Japan and Arizona.

However, it is thought to be keeping most of the fabrication of its advanced products in Taiwan, and analysts predict that in less than three years’ time, Taiwan will be responsible for 47% per cent of global 12inch wafer production and will have developed approximately 60% of the electronics industry’s advanced fabrication processes.

So given the importance of maintaining Taiwan’s enormously significant global supply of semiconductor devices, it would seem that its “silicon shield” will serve to keep the island safe for the future.