Gallium Market Growth and Semiconductor Demand Outlook

Insights | 03-10-2025 | By Matthew Walker

![]()

Key Things to Know:

- Gallium demand is rising as GaN and GaAs semiconductors drive innovation in 5G, renewable energy, and electric vehicles.

- Supply is constrained, with most refined gallium originating from China and limited primary mining capacity worldwide.

- Recycling remains challenging, as recovery from industrial waste is possible but not yet cost-effective at scale.

- Forecasts diverge, but all agree that semiconductor growth is the main driver of gallium’s future importance.

Recent industry reports suggest that the global gallium market could nearly double by 2035. While such projections capture attention, the real significance of gallium lies not in commodity speculation but in its growing role as a critical enabler of semiconductor innovation.

Gallium compounds such as gallium nitride (GaN) and gallium arsenide (GaAs) are increasingly vital to modern electronics. GaAs has long been central to high-frequency devices and optoelectronics, while GaN is powering advances in electric vehicles, renewable energy systems, and 5G infrastructure. As demand rises, gallium is shifting from an overlooked by-product to a material of strategic importance for the semiconductor sector.

Market growth, however, must be viewed through two lenses: adoption in next-generation electronics and the realities of supply, extraction, and geopolitics. Understanding both factors is essential for engineers and industry stakeholders tracking the future of gallium demand in semiconductors.

The Role of Gallium in Semiconductors

Unlike many industrial metals, gallium’s value is not tied to its pure metallic form but to the compounds it creates. When combined into gallium arsenide (GaAs) and gallium nitride (GaN), the material demonstrates electronic properties that silicon alone cannot match. These compounds enable devices that operate at higher frequencies, greater efficiencies, and withstand harsher operating environments.

In practice, GaAs semiconductors remain essential for RF electronics, satellite communications, and optoelectronics.

Meanwhile, GaN semiconductors are rapidly emerging in power conversion systems for electric vehicles, renewable energy integration, and advanced wireless infrastructure. Together, they underpin many of the next-generation technologies driving growth in the global electronics sector.

Beyond Silicon: Why Gallium Matters

While silicon continues to dominate mainstream computing and consumer devices, its physical limits restrict performance in high-power and high-frequency applications. Gallium-based compounds bridge this gap, offering superior bandgaps, higher breakdown voltages, and faster switching speeds. As a result, gallium electronics are increasingly viewed as strategic assets in sectors ranging from aerospace to automotive.

Despite these strengths, GaN still faces technical hurdles such as the GaN vs Silicon: The P-Type Problem, which continues to challenge device design and scalability.

Recent peer-reviewed research highlights this trend. A critical review of gallium production and extraction confirms that demand for gallium compounds is set to accelerate in line with semiconductor adoption, reinforcing the material’s rising importance in global technology supply chains.

Market Forecasts and Academic Models

Commercial forecasts often present strong growth numbers for the gallium demand forecast, with some industry outlets suggesting the market could nearly double by 2035. While such projections provide a useful news hook, they often lack transparency in methodology and are typically framed in financial rather than technical terms. For engineers and decision-makers in the semiconductor sector, it is more insightful to consider academic studies that model adoption curves based on real technology uptake.

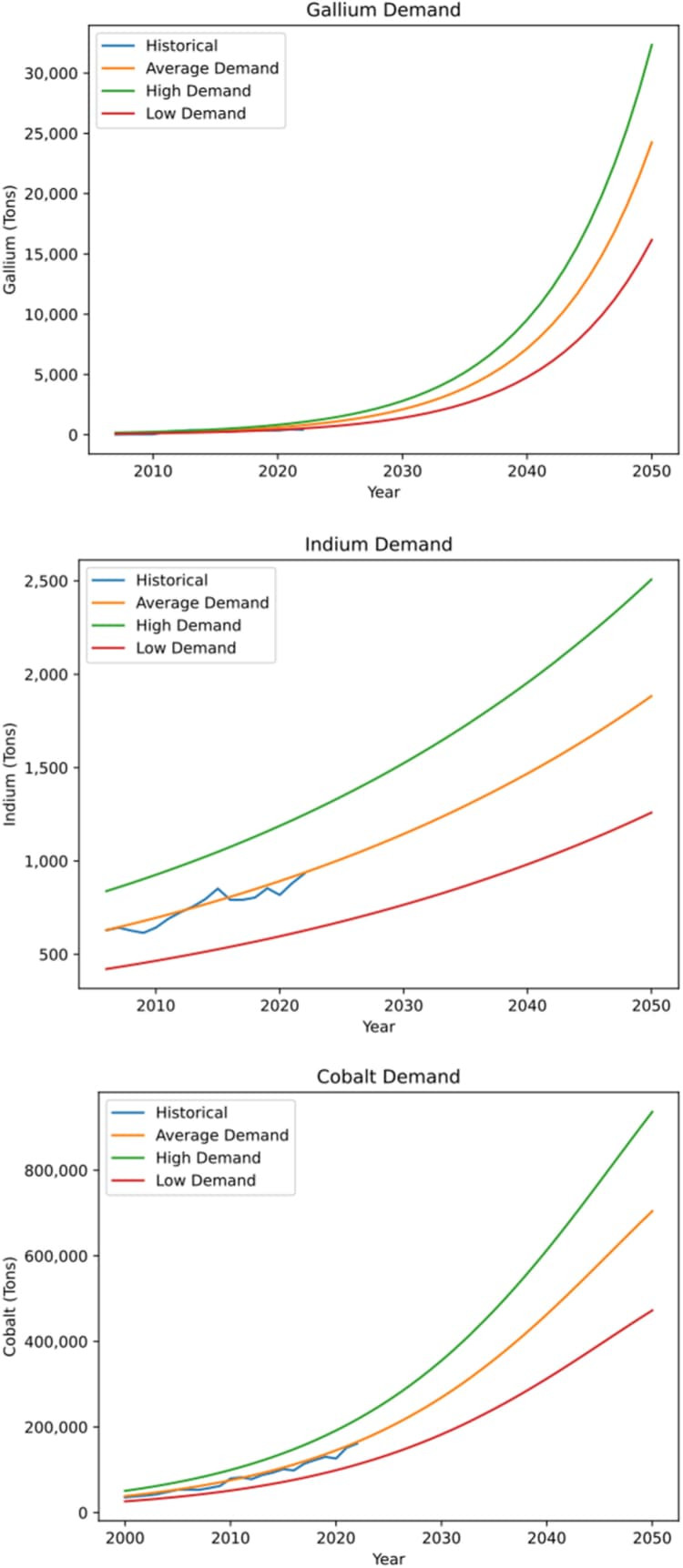

One such study applies a Bass diffusion model to critical materials, including gallium. The analysis forecasts demand growth not as a straight-line projection of market optimism but as a curve reflecting technology adoption patterns. This approach captures how gallium use expands as GaN and GaAs devices penetrate markets such as 5G infrastructure, power electronics, and renewable energy systems.

Electronics Uptake as the True Driver

The study highlights that gallium’s future is inseparable from the growth of semiconductor technologies. Adoption curves suggest steady expansion, with demand rising as advanced applications mature and new ones emerge. While precise figures vary between sources, there is broad agreement that the trajectory of semiconductor materials growth will continue to push gallium demand upward, independent of short-term commodity speculation.

Global demand projections for gallium, indium, and cobalt to 2050, with low (red), average (orange), and high (green) scenarios; historical data shown in blue. (Click to Enlarge)

Supply and Production Outlook

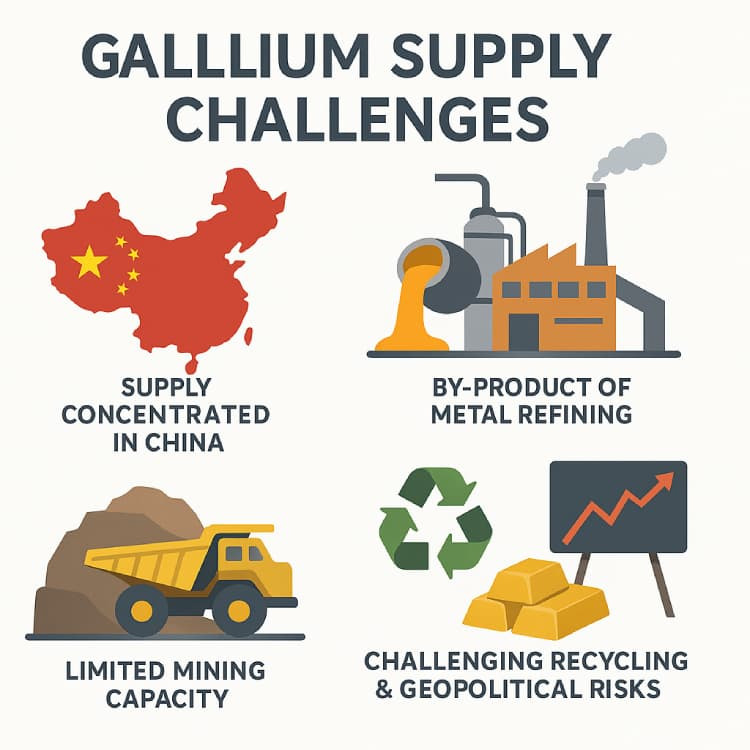

While demand for gallium in semiconductors is accelerating, supply growth remains less certain. The USGS World Minerals Outlook provides a government baseline, showing that global production capacity is limited and tightly concentrated. Unlike silicon, gallium is not mined directly in large volumes but is typically recovered as a by-product of aluminium and zinc refining. This structural limitation means that production cannot be easily scaled in response to rising demand.

At present, the majority of gallium supply originates from China, with few alternative sources available at industrial scale. This concentration raises clear risks for downstream markets reliant on GaN and GaAs devices, particularly in regions seeking to secure independent supply chains. Attempts to expand gallium mining capacity face both technical and economic challenges, as the element is rarely found in high enough concentrations to justify primary extraction.

Extraction and Recycling Constraints

Academic reviews of gallium production have underscored the difficulties of extraction and recycling. Recovery from industrial waste streams is technically possible but not yet cost-effective at scale. This creates a tension between strong gallium recycling ambitions and the realities of current processing technology. As a result, the semiconductor sector faces a supply landscape where demand acceleration may outpace the ability of producers to respond, amplifying both price volatility and geopolitical risk.

Gallium supply and recycling challenges, showing reliance on China and technical barriers to large-scale recovery. (Electropages Infographic)

Strategic and Geopolitical Risks

The fragility of the gallium supply chain has less to do with geology and more to do with geopolitics. With over 90% of global refined gallium coming from China, the world’s semiconductor sector is highly exposed to a single processing hub. This concentration has turned gallium from a relatively obscure material into a lever of strategic influence.

China has already demonstrated how export controls can reshape the market. Restrictions not only reduce availability but also inject uncertainty into long-term planning. For manufacturers building GaN power devices or GaAs RF components, unstable supply chains translate directly into pricing pressures and potential production delays.

Governments have begun to treat gallium as a critical material, with strategies emerging across the US, EU, and Japan. These typically focus on:

- Stockpiling refined gallium to buffer against export shocks.

- Investing in recycling and recovery research to reduce dependency on primary refining.

- Exploring alternative suppliers, although viable options remain limited.

While these measures may ease some risks, they cannot quickly offset Chinese dominance. For now, semiconductor security depends as much on political stability as on technical innovation. That reality is already influencing procurement strategies across the electronics industry.

Technology Drivers Behind Demand

The real momentum behind gallium comes not from speculative markets but from the technologies that rely on it.

Each new generation of electronic systems is demanding higher efficiency, faster switching, and operation at frequencies that push silicon to its limits. In this space, gallium compounds are becoming the material of choice.

In communications, 5G semiconductors based on gallium arsenide already form the backbone of RF front-ends used in smartphones, base stations, and satellites. As research transitions towards 6G, the need for high-frequency performance will only strengthen GaAs’s role. Meanwhile, gallium nitride is advancing in a very different but equally important direction. GaN power devices are enabling smaller, lighter, and more efficient converters, making them a natural fit for renewable energy systems and the fast-growing electric vehicle sector.

Beyond automotive and renewables, GaN in AI data centres is also transforming power delivery, where efficiency and density are paramount for next-generation computing and industrial systems.

GaN in Data Centres and Industrial Systems

Defence and aerospace add yet another layer of demand. From phased-array radar to secure satellite communications, these industries depend on materials that can deliver power and reliability under extreme conditions.

Gallium nitride is proving itself in applications where performance margins are critical, and in some cases, where entirely new classes of technology, such as directed energy systems, are emerging.

This spread of applications shows how gallium in EVs, renewable systems, telecoms, and aerospace has moved the material from niche to indispensable. It is no longer serving just one industry; gallium now underpins several strategic sectors that collectively drive the future of semiconductors.

Balancing Gallium Forecasts

Forecasts for gallium tend to fall into two camps. On one side, market studies emphasise strong gallium growth as compound semiconductors push deeper into automotive, renewable, and communications sectors.

On the other hand, government data such as the USGS World Minerals Outlook offers a more restrained view, with production expected to expand only slowly as it remains tied to aluminium and zinc refining. The result is a split between demand optimism and supply realism.

Academic modelling points towards a baseline scenario where adoption follows a steady curve. In this case, gallium demand grows at a controlled pace, broadly aligned with existing projections of semiconductor market outlook. A more aggressive path is also possible: if GaN accelerates its penetration into electric vehicles and renewable energy systems faster than expected, demand could climb sharply, stretching today’s fragile supply chain.

The real risk, however, lies in the opposite direction. If supply bottlenecks tighten, whether through export restrictions, limited recycling progress, or underinvestment in recovery capacity, then even strong demand cannot translate into secure availability. Such a scenario would inject volatility into pricing and create design challenges for manufacturers who depend on stable access to critical materials.

For engineers and procurement specialists, the lesson is clear. Forecasts alone cannot capture the full picture. A balanced view recognises both the opportunities and the gallium risks that could shape the semiconductor industry over the next decade.

Gallium as a Critical Semiconductor Material

From RF front-ends in 5G networks to high-efficiency power devices in electric vehicles, gallium is steadily moving into the mainstream of semiconductor innovation. Once considered a marginal by-product of aluminium and zinc refining, it now sits at the heart of technologies shaping communications, transport, and defence.

Forecasts differ in scale and confidence, but all point to the same underlying trend: gallium demand is driven by semiconductors, not commodity speculation. Whether growth follows a steady curve or accelerates with rapid GaN adoption, the trajectory is clear. Supply, however, remains the limiting factor and will continue to shape how markets evolve.

Gallium is no longer just a niche by-product; it’s becoming a strategic cornerstone of next-generation electronics.

For deeper coverage of the technologies shaping the semiconductor industry, read the Electropages Digital Magazine.