ECIA Survey: Surging Confidence in Electronics Components Market

Buyer News | 11-01-2024 | By ECIA

This featured article, authored by Dale Ford, Chief Analyst at the Electronic Components Industry Association (ECIA), provides an in-depth look into the growing confidence among electronic components supply chain participants as they anticipate the trends of January 2024. This analysis is based on the insights from the ECIA's December 2023 Electronic Component Sales Trend (ECST) survey, offering a valuable perspective on the industry's optimistic outlook.

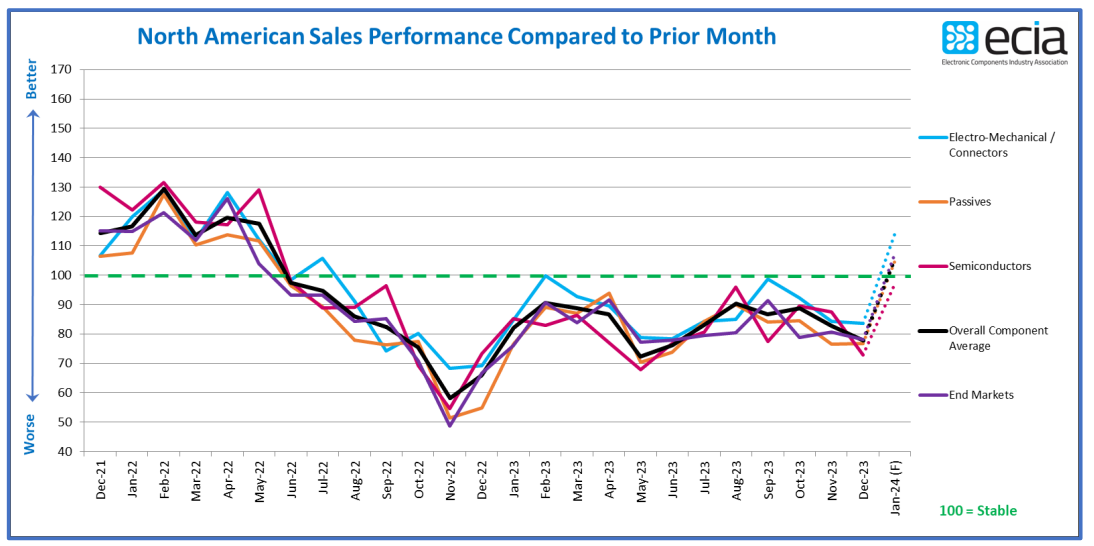

Following a year where overall index scores hovered between 72.2 and 90.6, respondents to the December Electronic Component Sales Trend (ECST) survey have shown a remarkable shift towards optimism for January 2024. The actual sentiment index for December stood at 77.8, falling short of the anticipated 83.3. Throughout 2023, no major component segment reached or surpassed the 100-point mark, which indicates positive sales growth sentiment. However, expectations for January have soared by 27.8 points in the overall index, reaching an average of 105.6 points. This projected growth, if realised, could mark the strongest month-to-month growth in the history of the index, barring an exceptional month in June 2020. While caution is advised due to past discrepancies in expectations and actual results, this surge in optimism is a positive sign as we enter 2024.

Category-Specific Forecasts

Electro-Mechanical / Connector Category

This category nearly breached the 100-point threshold twice in the past year and now leads the January outlook with a score of 114.4, a significant 30.7-point jump from December.

Passive Components

The Passive components category is projected to rise to 105.2 in January, marking a 28.4-point increase.

Semiconductor Category

Despite its 24.4-point leap, the Semiconductor category is forecasted to fall just short of the 100-point mark, with a projection of 97.4 for January.

Caution and Confidence in the Forecast

Despite the optimistic outlook for January 2024, a note of caution is sounded due to previous instances where the index fell short of expectations. However, even if the index realises half of the forecasted improvement in January, it would signify an extremely healthy start to the year.

Reporting Segments' Expectations

Manufacturer representatives, traditionally the most conservative in their projections, anticipate an improvement of over 25 points between December and January. Distributors and Manufacturers are slightly more optimistic, expecting improvements of 29.3 and 27.9 points, respectively. This strong base of expectations across all major reporting segments bolsters confidence in the overall outlook.

End-Market Index and Lead Time Stability

The overall end-market index mirrors the component indices, with a forecasted January leap of 29.5 index points. Every end-market segment is expected to see significant improvements, with Industrial Electronics poised for the largest increase of over 36 index points. The highest forecast index score for January is in the Avionics/Military/Industrial segment at 136 points, while Consumer Electronics has the lowest at 88 points. However, the Consumer Electronics outlook for January is higher than all but two of the actual scores for end-market segments in December.

Lead Time Trends

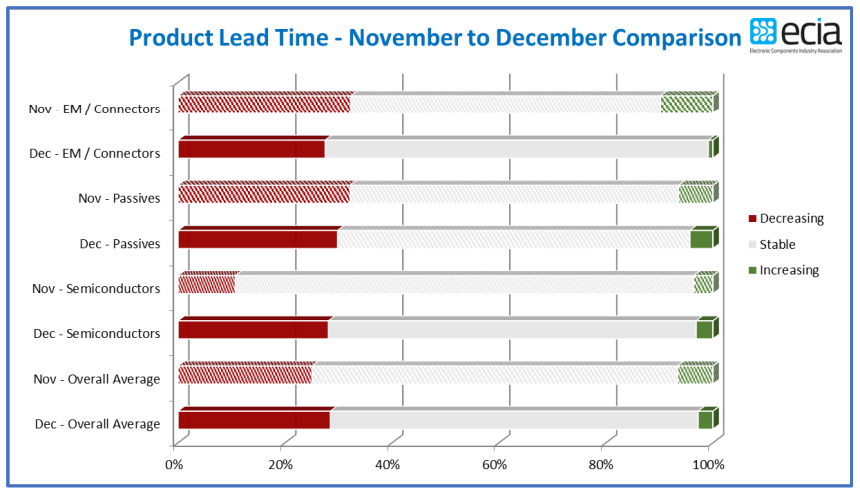

December saw continued stability in product lead times, particularly in the Electro-Mechanical/Connectors and Passive segments. The Semiconductor category experienced an increase in reports of decreasing lead times. On average, 69% reported stable lead times, while reports of increasing lead times were minimal at 3% in December.

ECIA Survey: Long-Term Industry Outlook

The ECST survey offers valuable insights into near-term industry expectations, aiding participants throughout the electronics components supply chain. In the long term, the ECIA shares in the industry's optimism, driven by the ongoing introduction and market adoption of innovative technologies, which are expected to spur both corporate and consumer demand for next-generation products.

About the ECST Report

The complete ECIA Electronic Component Sales Trends (ECST) Report, offering detailed data on current sales expectations, product cancellations, and lead times, is available to all ECIA members and survey participants. The report covers six major electronic component categories, six semiconductor subcategories, and eight end markets, segmented by responses from manufacturers, distributors, and manufacturer representatives. Participation in the ECST report is highly encouraged for all involved in the electronics component supply chain, as it provides invaluable insights and perspectives.

Non-members can now purchase the ECST report at https://www.ecianow.org/purchase-reports