How Close Is China to World Dominance in Legacy Semiconductors?

Insights | 27-02-2024 | By Paul Whytock

Key things to know:

- China's Semiconductor Ambitions: The nation's aggressive expansion into both the legacy and high-end semiconductor markets poses significant concerns for global competition and technological dominance.

- Global Response to China's Strategy: Actions such as the U.S. CHIPS Act and the European Chips Act represent strategic investments and international collaboration efforts to diversify supply chains and reduce dependency on China.

- Impact on Global Markets: China's potential dominance in legacy chip production could have far-reaching implications for security, economic stability, and the geopolitical landscape.

- Strategic Importance of Legacy Chips: Despite being older technology, legacy chips are crucial for a wide range of applications, including military, medical, and automotive industries, highlighting the need for a secure and diversified supply chain.

When it comes to the global semiconductor business, there are a lot of chip manufacturing countries that are scared stiff about how China could not only grab a large chunk of the World’s legacy chip market but also reach a position of technological excellence when it comes to high-end devices.

Do they have good reason to be worried? The answer is yes.

Escalating Concerns Over China's Semiconductor Strategy

Recent developments have heightened these concerns, as Nikkei Asia reports the U.S. is increasingly wary of a 'flood' of older-generation chips from China. This influx threatens to undermine global semiconductor competition and could potentially leverage Beijing's influence in critical sectors, from consumer electronics to military applications.

China has already demonstrated an ability to storm into World markets that are driven by technology and grab large chunks of market share.

An overwhelming example of this is the electric vehicle market. From a position of very little expertise twenty years ago, China now produces advanced cars at reasonable prices that are winning impressive numbers of international and domestic sales. More on how it achieved this in a moment.

And it’s not only corporate paranoia when it comes to China’s chip business. Let’s not forget America and the EU’s fears. Such was the level of this that back in 2022, President Biden introduced a raft of export controls in an attempt to cut China off from advanced semiconductor intellectual property (IP) and cutting-edge chip production equipment.

The production of advanced chips is the most antagonistic technological concern between the United States and China.

Those Biden rules mean US companies cannot supply Chinese chipmakers with advanced chip production equipment unless they are granted a licence authorising them to do so.

In addition to that, the US increased export controls to include semiconductor products and the advanced software used to develop and make high-end integrated circuits. If that wasn’t enough, American citizens could also be banned from working on certain technology for Chinese companies.

As for the EU’s position on these restrictive manoeuvres, it has been quoted by numerous Asia Pacific media companies as saying it will stand with the US in attempting to restrict China’s progress on cutting-edge semiconductor devices by also holding back chip development IP and advanced manufacturing machinery.

China’s Electric Vehicle Boom

As mentioned earlier, China has astounded the World’s electric vehicles (EVs)) manufacturers with the rapid development of its EV business and the fact the country has become a leading global supplier of EVs.

It's worth noting that China’s Shanghai Gigafactory is currently Tesla’s most productive manufacturing hub and accounts for half of Tesla cars delivered in 2022.

How has it achieved this global position? Back in 2008, China began offering financial packages to encourage the creation of its own EV factories that would produce buses, taxis, or cars for individual consumers. Back then, only about 300 EVs were sold annually.

From then until 2023, the Chinese government poured more than €34billion into subsidies and tax breaks for vehicle manufacturers, which meant by the end of 2023, the country had sold 5.65million EVs worldwide. This figure means they accounted for over half of global sales. And all of that was achieved in a mere 15 years.

Moreover, the strategic pivot towards dominating the legacy chip market underscores a broader ambition. According to The Foundation for American Innovation, this move could have far-reaching implications, not just economically but also for global security. The reliance on legacy chips in everything from consumer appliances to critical military systems makes the stakes particularly high.

So, what’s the relevance behind China’s car business when it comes to the global chip market? Simply put, it means they have the money, the technical ability and an enduring long-term attitude to do the same.

Bread and Butter Technology

Obviously, China would like to be a major player when it comes to high-end sophisticated semiconductor devices, but that doesn’t mean they are not interested in the bread-and-butter end of the market, particularly when it comes to legacy products. In fact, they are very interested in the legacy market, and there are some very good reasons why.

Legacy devices make up a huge amount of global chip sales.

Most chips manufactured today are not advanced chips but legacy chips, and around 71% of devices currently sold are made using software and production equipment created more than twenty years ago.

When it comes to market importance, it's right to say that legacy devices hold just as important a place, if not more so, than advanced semiconductor devices. And this is something China has clearly recognised. They have a significant influence in a variety of market sectors, including military, medical, industrial systems and home appliances. It is also a fact that over 90% of the integrated circuits used in the automotive industry are legacy devices.

Currently, the main suppliers of legacy devices are located in Taiwan and China, and it’s obvious that China wants to maximise its position to the extent that possible monopoly situations could develop with the subsequent problems relating to supply and demand and pricing structures that such situations can exacerbate.

China's Strategic Investments Post-U.S. Export Controls

Industry observers are aware China has been investing heavily in the manufacturing of legacy chips ever since America introduced the aforementioned export controls to stifle the export of chip technology-related products to China.

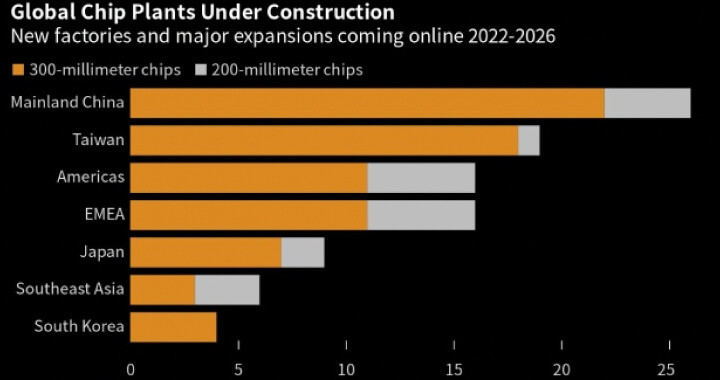

Some analysts have gone as far as to say that China may build more legacy chip fabs in the next few years than the rest of the World combined. It is somewhat incongruous that restrictive trade controls and attitudes by the US and the EU designed to stagnate China's progress with advanced semiconductor devices could create a situation where China becomes dominant in the area of legacy devices.

The urgency of addressing this issue is echoed by industry experts and policymakers alike. As The Foundation for American Innovation highlights, the potential for China to leverage its position in the legacy chip market raises concerns about supply chain security and the geopolitical leverage this could afford Beijing, particularly in relation to the U.S. and its allies.

More Export Controls

So it comes as no surprise that the US is now calling for speedy action on what it likes to call foundational devices when it considers China’s ambitions.

By the way, ignore the term foundational semiconductors. It’s just another name for legacy chips!

According to Malcolm Penn, the industry-experienced CEO of Future Horizons: “We are seeing huge investment in China, way beyond what its internal market can sustainably consume. If older-generation Chinese-made chips produced at its new foundries are oversupplied to the global market, analysts worry it could lead to price wars, undermine efforts to develop alternative semiconductor supply chains and lead to further trade restrictions.”

Should chipmakers in the West be worried? Yes, they should.

China's Aggressive Expansion in the Semiconductor Industry

In September 2023, Reuters reported that China was set to launch a new state-backed fund aimed at raising about €43bn to support its chip industry, and according to research analysts, the Rhodium Group, in less than ten years, China is expected to domestically add nearly as much 50–180nm wafer manufacturing capacity as the rest of the World.

The views of industry analysts and observers vary, but generally speaking, it’s thought that 22 wafer fabs are being built in the country, and there is an overall plan to create a total of 30 new wafer fabrication plants. Many of these will concentrate on the production of legacy devices. As for market share, industry intelligence gatherers Trendforce believe China’s legacy chip manufacturing base could provide as much as 30% of the global demand for older devices.

Global Response to China's Legacy Chip Expansion

However, other countries, including the United States, will not just bow out of the legacy chip market. The US Chips Act, which became law in 2022, provided $ 6 billion specifically to encourage the domestic production of such devices. And the European Union has gone even further.

The European Commission has implemented a budgetary plan relating to the European Chips Act that will release €17billion euros in public and private investments until 2030. This is in addition to a substantial €30 billion investment that had previously been earmarked.

As European Commission President Ursula von der Leyen has said: “The pandemic painfully exposed the vulnerability of semiconductor supply chains. The global shortage of chips slowed down our recovery. We have set the goal to have, in 2030, 20% of the global market share of chip production here in Europe. Currently, we are at 9%.”

Make no mistake. In making this commitment, the EU has made it clear that a good proportion of this investment will relate to legacy chip production, which Europe’s car makers, and particularly Germany, depend on.

Securing Legacy Chip Supply Amidst Geopolitical Tensions

This need to have a secure supply of legacy chips for so many well-established industry sectors does raise one very important question related to China’s ambition to lead the global legacy chip market. And that is, will its supply remain constant and not be liable to become a tool in any political or military disputes with the West?

Perhaps the answer to that question lies in this question?

If you were a major Western manufacturer of cars or white goods, would you settle for having China as your number one supplier of legacy chips, knowing that supply could be cut off? Or would it make more sense to have them as the second source supplier, with a domestic manufacturer occupying the number one slot?

The answer to that is probably yes. But could that domestic supplier compete on price? The answer to that is probably no, not without some big juicy subsidies coming from somewhere.

Strategic Responses and Future Directions

Addressing these challenges requires a multifaceted approach, combining strategic investments, like those outlined in the U.S. CHIPS Act, with international collaboration to diversify supply chains and reduce dependency on a single source. The concerns raised by The Foundation for American Innovation underscore the importance of a proactive and coordinated response to ensure the resilience of global semiconductor supply chains. Moreover, as the geopolitical landscape continues to evolve, the urgency for securing a stable and diversified semiconductor ecosystem has never been more critical. Initiatives such as the European Chips Act and similar strategic investments globally are pivotal in fostering innovation, competitiveness, and security across the semiconductor industry.

Furthermore, the development of domestic capabilities in semiconductor manufacturing, research, and development, coupled with policies aimed at safeguarding intellectual property and nurturing talent, will be instrumental in maintaining technological sovereignty and economic security. The global nature of the semiconductor supply chain necessitates a collaborative approach, where countries and companies work together to mitigate risks, enhance supply chain transparency, and promote fair trade practices.

In conclusion, the path forward demands a concerted effort from governments, industry leaders, and the international community to address the vulnerabilities exposed by the current semiconductor landscape. By embracing innovation, reinforcing partnerships, and prioritising sustainability, we can pave the way for a more resilient and equitable global semiconductor market. The stakes are high, and the time to act is now, to ensure that the backbone of our modern digital economy—the semiconductor industry—remains robust and responsive to the challenges of the 21st century.